En el presente artículo, se comparte la entrevista realizada a autoridades de la empresa GLOBAL ORDNANCE (EEUU), en relación con las capacidades locales de producción de munición de artillería 155 / 152mm, Los desafíos que actualmente se presentan y afectan la cadena de abastecimiento de insumos críticos en las plantas productivas, son la escasez de TNT (Para el llenado de las cabezas de guerra) y de Nitrocelulosa (Para la fabricación de las cargas propulsantes). La alta demanda de munición generada por los conflictos en Ucrania y Medio Oriente, han llevado los stocks de insumos críticos a mínimos aceptables. Teniendo en cuenta que los citados conflictos continuarán y se avizoran futuros escenarios de guerra, se plantea la necesidad de repensar la estrategia de obtención global de esos insumos y, eventualmente, la posibilidad de incorporar nuevas capacidades de producción propia de TNT y Nitrocelulosa, que garanticen el autoabastecimiento local y de los países aliados.

As a large supplier of 155mm and 152mm artillery shells, Sarasota, Florida-based Global Ordnance requires tons of trinitrotoluene (TNT) for the explosives in its warheads and nitrocellulose to make the propellants that launch those shells. In addition, there is a tremendous need for TNT by commercial mining companies. However, the conflicts in Ukraine and the Middle East have caused major shortages of both of these essential chemical compounds. Complicating matters further, the U.S. has not produced its own TNT for decades.

During the recently concluded SOF Week conference in Tampa, we spoke with Johnny Summers, vice president of energetics for Global Ordnance, about the shortages and their effect on the ability to produce enough artillery shells to meet U.S. and NATO needs.

Some questions and answers were lightly edited for clarity.

Q: Tell us about the effects of the ongoing shortage of TNT.

A: We had a procurement contract with Zarya in Ukraine to bring material to the U.S. for U.S. government contracts and commercial customers. We had brought 2,000 metric tons of that material to the U.S., part for the U.S. government and part for commercial sales, until the war kicked off in 2022, and immediately that factory was behind enemy lines and is out of capacity production since. So we’ve been working to try to replace that for our customers over that period of time, due to the expanding need for TNT, due to multiple conflicts, both in Israel and in Ukraine. TNT has been a huge requirement. To that point, the U.S. government has recently issued a contract to establish a TNT manufacturing facility in Kentucky. That’s actually a program that our company bid on, and we weren’t awarded that contract. So we’re continuing to work with suppliers around the world to be able to locate TNT for our customers.

Q: Now, where are you looking for TNT, given the global competition?

A: A lot of people are looking for it, and there’s a lot of capacity from banned locations. So China is offering TNT around the world, and we get offered it one or two times a week from various brokers that approach us. We’re not allowed to procure that TNT from China, so we don’t, thank you very much. We’re looking at other sources in other countries. I don’t want it to divulge too much at this point, but we are in negotiations with a couple of other factories in other countries that aren’t on the banned list, where we can potentially bring in TNT, both for the U.S. government and for our commercial customers.

Q: What are your commercial customers saying?

A: Before the war kicked off, there were two price ranges for TNT. There were the commercial prices, and then there were government prices. And they were fairly decently apart. We were selling the same TNT from Zarya, but the U.S. government wanted it tested and packaged differently so they get a different price. And it has to come on a U.S.-flagged vessel, which triples the price of shipping compared to your commercial customers. But now the commercial market is having to pay the same price as the government customers for that TNT, and it’s gone up probably fourfold in the last four years.

Q: What’s the price point on that?

A: If you’re selling to a U.S. government customer, on U.S.-flagged vessels, we’re talking about $20 a pound.

Q: And for commercial customers?

A: A little bit less, because we don’t have to use U.S.-flagged vessels, but the TNT itself is just as expensive.

Q: What’s the ratio between the need for TNT for the U.S. government and commercial companies?

A: The U.S. government posted a Sources Sought Notice for TNT for a period covering Fiscal Years 2027-2031. The range of requirements is from 1 million pounds to 8 million pounds per year. We have a current U.S. commercial requirement for 2025 for 4.4 million pounds. These are the data points that I have.

Q: Given these issues, how difficult is it to put this all together to make shells?

A: Well, the TNT is manufactured from a bunch of chemicals. So those aren’t necessarily hard to come by. A lot of places make those, but building the factory is difficult because you have to have special storage tanks for each one of those components, and then supply lines and a factory to put it together and test range storage bunkers to put it in while you’re manufacturing it, before you ship it out. So it’s a big investment to build a TNT factory, both footprint-wise, environmental protection restrictions, and so forth. So that’s why you don’t see a whole lot of them around the world. The U.S. hasn’t made TNT in decades.

Q: Would Global Ordnance consider building its own TNT factory?

A: No. We bid on the U.S. government opportunity for that, because they were offering up a U.S. government facility that had been tailor-made for those types of commodities, so that you don’t have to start from scratch.

Q: In your proposal, did you see that the production capacity capability would eventually meet the need, and over what period of time?

A: The question becomes the longevity of the two conflicts, and how much artillery ammunition is being consumed over time, because that’s the big driver for TNT right now, which is both 155mm and 152mm artillery. That’s the big consumer of TNT on the defense side.

Q: There’s a European effort to increase the production and flow of artillery rounds. How much is that going to be impacted or affected, if at all, by this global shortage of TNT?

A: It affects all the factories, but there’s a trickle down to that as well right now because we have multiple contracts to produce 155mm artillery shells throughout Europe. The U.S. government is our biggest customer because they’re delivering those to Ukraine, those are TNT-filled 155mm rounds. But the TNT is not the biggest shortage at the moment. It’s the propellant for the propellant bags. That is a bigger shortage at the moment.

Q: What are the components of the propellant bag?

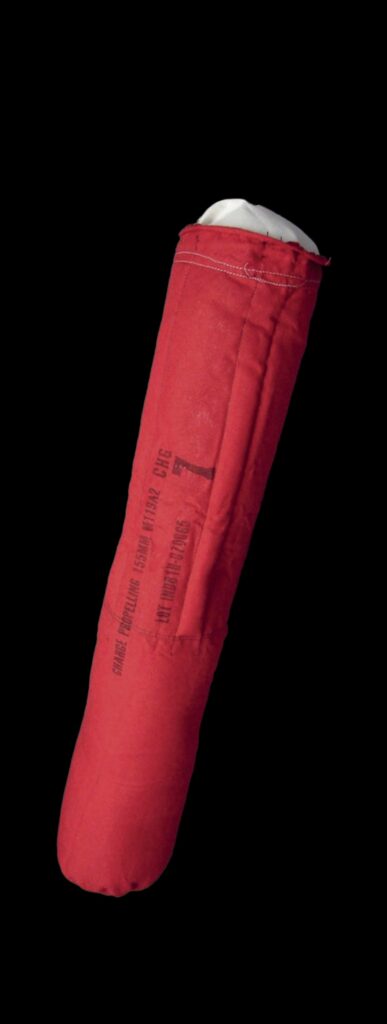

A: It depends on the type of range. You have different zones of fire. If you’re trying to go the maximum range, that’s what they call a red bag and that uses an M6 propellant. And you start with nitrocellulose to build the propellant.

Q: And there’s a huge shortage of nitrocellulose?

A: There’s a shortage right now of nitrocellulose used to make the propellant, because most of the propellant factories are saying, if you can get us more nitrocellulose, then we can give you more propellant.

Q: How much nitrocellulose do you need?

A: You need approximately 20 pounds of dry nitrocellulose to make the propellant required for each M119 propellant charge that goes with an artillery shell. We are currently delivering 2.2 million pounds of nitrocellulose to North America to make propellant.

Q: How difficult is that to produce?

A: It’s a lot easier than TNT. It’s a smaller factory footprint and mixing, and it’s mixed with pure cotton. And then for packaging, for shipment, it’s mixed with denatured water so it can be shipped safely. And then once it gets to the factory, they have to evaporate all that water out before they actually use it to make the propellant charge.

Q: Is Global Ordnance interested in creating a propellant factory?

A: A propellant factory is a big piece as well, a multiple-step process, buildings scattered out, and conveyance systems. We’ve looked into potentially looking at nitrocellulose production capacity.

Q: So, where is the nitrocellulose made?

A: The ones that we’re aware of, personally, China makes that as well, in large quantities. We’ve got a contract to procure some from Taiwan. There’s also a factory in Brazil. Most of these factories that exist don’t do high volume. We work with a propellant manufacturer in Canada, and their annual requirement for propellant is about 5,000 metric tons. So that’s a lot of nitrocellulose.

Q: Given where your suppliers are, how concerned are you about the supply chain being cut off? And what would that do?

A: Obviously, the force majeure clause comes into play contractually. But it doesn’t help our customer or us be able to get our material to where we need it to go. That’s why we really focus on trying to have multiple sources of supply geographically, not just within a region. We’ve run across these things before. Obviously our TNT factory being in a war zone cut that off.

Q: How much TNT were you getting from Zarya?

A: Well, we had brought over 2,000 metric tons, but we were planning on bringing 5,000 tons a year of TNT.

Q: What are you hearing about the demand signal for a potential conflict between China and Taiwan? Is there any kind of buildup for that?

A: Nothing that’s been categorized as for Taiwan, but we’ve worked through a lot of inventory that the U.S. had at a stockpile. So now we’re trying to replace that inventory, and then help replace the inventory of some of our NATO partners through foreign military sales cases.

Q: How depleted, from your point of view, were U.S. stocks as a result of the war in Ukraine? The U.S. has supplied Kyiv with more than three million rounds of 155mm artillery shells and nearly half a million 152mm shells.

A: I really can’t talk to that at all.

Q: How concerning is it that China has plenty of capacity and plenty of ability to produce shells, TNT, and repellent? North Korea is also providing Russia with a lot of shells. So they must have a large capacity as well, right?

A: [North Korean rounds] don’t work too well. They have a lot of accidents with their rounds.

Q: How concerning is it that China has this large supply that they rely on themselves and the U.S. has to rely on a very much more convoluted supply chain?

A: It really looks back at NATO. We work with our NATO partners to meet each other’s needs and whatever works out best from a business case in a peacetime environment, because none of the NATO countries by themselves can be completely self-sufficient. So you’re buying from this country. You’re selling this to that country to meet the needs for defense. China has always seemed to focus on being self-reliant when it came to its military needs, and that’s something you just have to prepare for and analyze, what the real risk is in that environment.

Q: Ukrainian President Volodymyr Zelensky says he anticipates receiving three million artillery shells from NATO countries. How realistic is their ability to provide this number of shells for Ukraine and for their own domestic needs?

A: NATO is quite capable of being able to get to that number. Getting there in a short period of time is a different discussion, because you’re talking about adding production lines. The U.S. Army has opened up multiple production lines in 2025 to be able to add to our own capacity internally. So I think all of the primary NATO nations are doing the same thing. They’re adding production lines in their countries so that they can make these pieces internally.

Q: How long does it take to start pumping out artillery shells?

A: If you’re talking about deciding to build a production facility from scratch, you’re probably talking four years. If you’re going into a facility that’s already had military production of explosives, you could probably carve that down to a two-year program. You start out with small-rate production, 3,000 a month, and then you’re trying to work yourselves up to a bigger number that you can get to.

Q: During a 2021 Congressional hearing, Adm. Phil Davidson, the retiring head of U.S. Indo-Pacific Command, said that China was gearing up to attack Taiwan by 2027. How concerned should U.S. military leaders be about having enough artillery shells to fight?

A: Well, I think during that time window, based on what we’re seeing globally for production, I think you’re going to have the needs met.

Q: Because of the ramped-up production?

A: Because of what lessons we’ve learned from Ukraine and the need for those weapons.

Q: Even with the shortage of TNT and nitrocellulose?

A: Yeah, the issue is that you will not have the same type of campaign if China invades Taiwan. You won’t have a linear battlefield where you’re having 1,000s of artillery systems firing all day long. It’ll be a totally different dynamic of a battlefield. So the needs for that conflict may be significantly different when it comes to artillery from what you’re seeing in Ukraine.

So far, a Chinese invasion of Taiwan and the need for artillery shells to defend it are in the realm of worst-case scenario planning. Time will tell if the ramped-up production will meet the needs of the U.S. and its allies as Russia’s war on Ukraine continues to rage on.

Fuente: https://www.twz.com